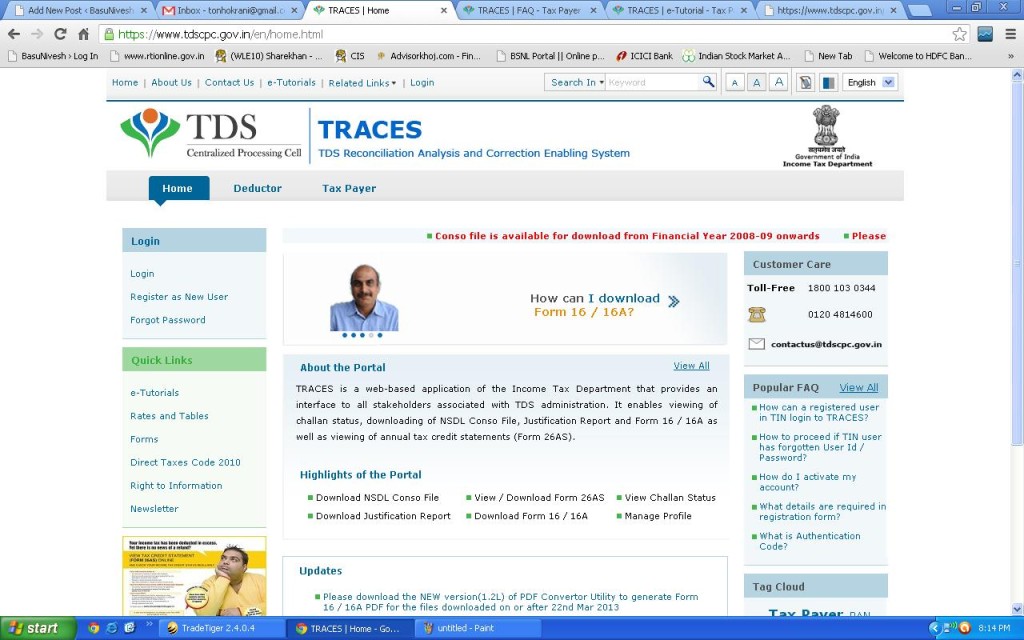

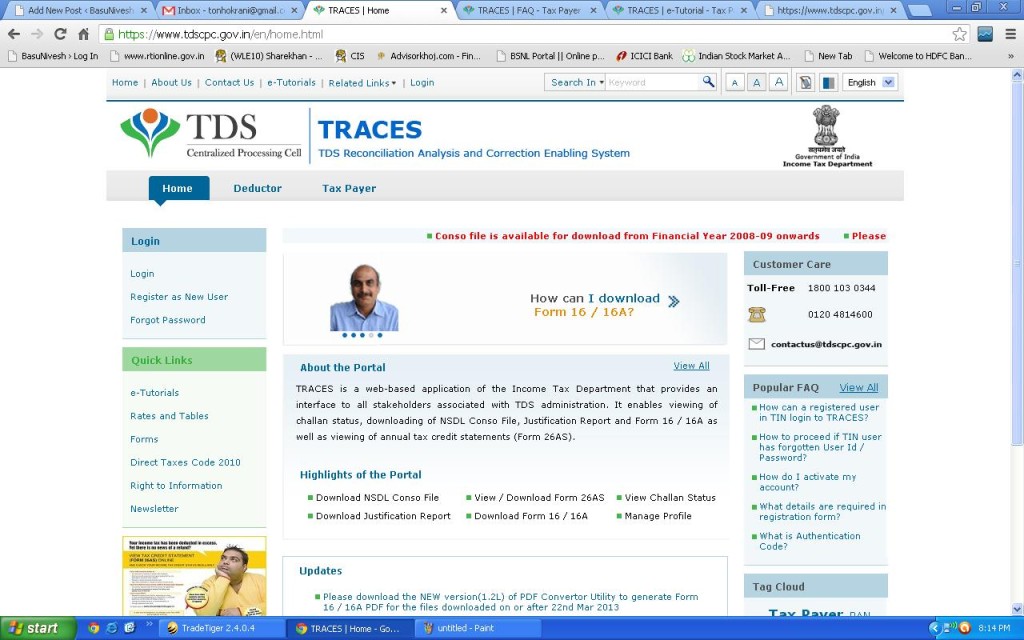

How to download or how to get Form 26 ASįorm 26AS can only be downloaded from the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website.

The list of Banks, which provide the facility of viewing Form 26AS, is as below:Ĥ. You can also view the list on the Income Tax Government’s website.

National Securities Depositories Ltd., or NSDL, provides a list of various banks authorised and registered to provide Form 26AS facility to its users. If your PAN is linked to your bank account, you can check your Form 26AS statement through net banking itself. Some banks also allow you to view Form 26AS through net banking. In TRACES, Form 26AS view will require you to enter your PAN details. There is an online portal called the TDS Reconciliation Analysis and Correction Enabling System or TRACES portal. TDS on rent for tenants is also included in this section.Īny defaults with regard to TDS payments associated with an individual’s PAN card are outlined in this section. This section has details about TDS for the sale of immovable property for the buyer. Part E of it has details for high-value transactions such as mutual fund purchases, bonds, property, etc. It contains specifics about any tax refund received in the financial year such as TAN refund, ITR refund, 26QB refund, etc. This section outlines any other taxes that have been paid apart from TDS or TCS, such as advance or self-assessment tax that may have been paid by the individual. Part B of it deals with tax collected at source (TCS) by a collector. Part A2 deals with TDS from the sale of immovable property for a seller. Part A1 deals with low or no tax deducted from Form 15G/15H. This section is further subdivided into two: Part A1 and Part A2.

Part A of it deals with tax deducted at source. Each of these parts deals with a specific tax component. Form 26AS is divided into 7 parts, from A to G.

0 kommentar(er)

0 kommentar(er)